M3 Revisited

I suspect very few of the fever swamp Austrians and tin foil hat brigade who lamented the demise of M3 ever actually made any serious use of these data. Not that they would get much out of it even if they tried, as James Hamilton argues:

I have to confess that in a quarter century of teaching and research, I never had any occasion to make use of M3. It always seemed to me that this unambiguously failed the definition of an asset that is used to pay for transactions. If you’re going to include such assets in your concept of “money”, why stop there? Don’t you want to include T-bills as well, and if them, why not Treasury bonds? You have to stop somewhere, and I always stopped with M1 or M2.

In addition, a primary reason for focusing on the money supply for policy purposes is that it’s a magnitude controlled by the government. The physical dollar bills are of course printed by the government, and a bank that issues checking accounts must hold credits that could be used to obtain physical dollars (known as Federal Reserve deposits) in a certain proportion to the value of the outstanding checkable deposits. However, it is unclear how the government is supposed to control the M3 components. Balances at foreign banks, for example, are clearly outside the control of the U.S. government.

I was thus a bit surprised at the brou-ha-ha that erupted over the Fed’s decision to discontinue requiring banks to provide the data that was used to calculate some components of M3. These concerns continue to bubble up in comments from Econbrowser readers.

I’m aware of no evidence suggesting that M3 helps predict U.S. inflation or economic activity better than M2.

I discuss the extent to which we should be concerned with broad money aggregates in my review of Tim Congdon’s, Money and Asset Prices.

posted on 01 June 2006 by skirchner in Economics

(0) Comments | Permalink | Main

Ben Bernanke: Soft on Inflation or Tough on Deflation?

The notion that Fed Chair Bernanke is somehow soft on inflation still has considerable resonance in financial markets and has been used to rationalise everything from rising commodity prices to USD weakness. The sole basis for this reputation is a couple of speeches Bernanke gave amid the 2002-03 global deflation scare, in which Bernanke made the simple observation that the Fed had quantitative tools available to it in the event that the zero bound became a binding constraint on the Fed funds rate.

This was little more than a straightforward application of the quantity theory of money and one that Milton Friedman would find unobjectionable (Friedman advocated an identical policy approach in the Japanese context). No one ever accused Friedman of being soft on inflation. It would be more accurate to say that Bernanke is tough on deflation. His preferences over inflation are appropriately symmetrical.

Stephen Jen is right when he says that:

The ‘credibility problem’ of the Fed is exaggerated: the complaint against the Fed is everywhere except in the bond prices or market indicators. As long as the Fed continues to tighten, the dollar will struggle to sell off.

James Hamilton examines the M2 data and finds little evidence of runaway inflation there either:

such money growth would not be expected to produce the sort of runaway inflation that some commentators think they detect in commodity prices. Furthermore, the 5% M2 growth rate of the last three years would be the sort of thing to get the economy back on track to a 1.5% inflation rate.

Obviously M2 is a pretty noisy indicator if you have to look to 10-year averages, and even then be careful. Nevertheless, it confirms a picture that I think emerges from any of a number of other indicators: the Fed was a little too aggressively expansionary a few years ago. That may have been responsible for a slight increase we’re seeing now in current inflation. However, the more restrictive measures adopted by the Fed over the last three years should help keep future inflation at acceptable levels.

Meanwhile, RBA Deputy Governor Stevens (adopting the broad historical perspective of his boss) addresses the so-called bond yield ‘conundrum:’

Against the backdrop of the past century, on the other hand, recent levels of long-term US interest rates do not look especially low; they look quite within the range of historical experience, especially experience when inflation was low. The 1970s and 1980s look more like the outlying period. Nor have spreads, for US corporate debt at least, been all that low when viewed from this longer perspective. There were lengthy periods in the mid part of the 20th century when spreads were as low as or lower than they are today.

Stevens also addressed the subject of global imbalances after his speech, in comments reported here:

“I perhaps have a slightly different view to much of the conventional wisdom here.

“I think that in the past decade the behaviour of the US has actually been stabilising for the global economy.

“I think to no small extent the rise in the US deficit was a lot to do with a rational response on the part of Americans to changes in prices.

“If it was really the case that the US was dragging this capital out of a world economy that was reluctant to give it, the price would have gone up. But the price didn’t go up, it went down.

“The quantity rose and the price fell - the supply curve moved.

“I think one might say it was a good thing that the Americans and others were prepared to use that capital because that kept the global economy going a lot better than it would have if things had been different.

“That isn’t to say that all of that can go on indefinitely. It can’t.”

If it’s not the conventional wisdom, then it should be. Strangely, Bernanke has also suggested that his global saving glut thesis is unconventional, yet it strikes me as an entirely orthodox position. It is those who persist in fretting about imbalances in a world of floating exchange rates and international capital mobility who are outside the bounds of contemporary macroeconomic thought.

posted on 29 May 2006 by skirchner in Economics

(0) Comments | Permalink | Main

Contrarian Indicator Alert

Barry Ritholtz points to one of our favourite contrarian indicators, but one which is giving mixed signals. Do we run with the bear on the cover, or the inside story which urges us to ‘stare down the bear’? Perhaps The Economist has at last recovered some semblance of its former intellectual modesty (but I’m staying bearish on that question).

posted on 26 May 2006 by skirchner in Economics

(0) Comments | Permalink | Main

Monetary Policy, Asset Prices and the Fed-Bashing Brigade

The Fed-bashing brigade often claim that the Fed is out of step with other central banks in not targeting asset prices, with the BoE and RBA in particular said to be more sympathetic to the idea. This is a misreading of the way in which these central banks think about asset prices, as this speech from the BoE MPC’s Paul Tucker suggests:

we just do not know enough about the determination of asset prices – especially of risk premia – to have much of an idea about what price to target. Big moves in asset prices do occasionally occur because of changes in the underlying economic fundamentals. We could not be relied upon to distinguish between those benign changes and bubbles. But even if we could, I don’t see how in practice we could use our single instrument (the overnight interest rate) to target both consumer price inflation and asset prices – especially when one remembers that there are lots of different asset prices and that questions of disequilibria about them may run in different directions.

In 2002-03, some of us on the MPC voted to maintain an unchanged policy rate rather than cut partly on the grounds that, by stoking the embers under household debt and house prices, too great a risk would be taken with future output and, most important, inflation variability. Speaking for myself, that was directed at avoiding policy settings that, on balance, could have increased uncertainty about demand conditions and inflation in the future, and complicated the operation of policy down the road, not on some spurious aspiration of steering asset prices along some (unknowable) equilibrium path.

posted on 26 May 2006 by skirchner in Economics

(0) Comments | Permalink | Main

Capital City House Price Inflation: Sydney versus the Rest

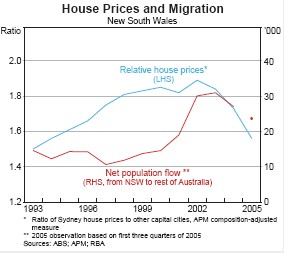

The ABS has released its March quarter house price indices, which continue to show divergence between house prices in Sydney and the other capitals. As we have noted previously, the heterogeneity in capital city house price inflation argues strongly against attempts to explain house prices with respect to national factors, such as fiscal and monetary policy. It also suggests that it is the economy that drives house prices, rather than the other way around. House price inflation is strongest in those states benefiting most from the commodity price boom, a development exogenous to the Australian economy.

The RBA’s most recent Statement on Monetary Policy noted the role of divergences in regional economic performance and inter-state internal migration as a driver of relative house price movements.

posted on 25 May 2006 by skirchner in Economics

(5) Comments | Permalink | Main

Capitalist Acts Between Consenting Adults

A Wall Street lawyer tries to auction his social security entitlements on Ebay:

Wojcik says he’s not breaking any laws or securities regulations.

“It’s not a security; it’s a person-to-person contract at a negotiated price, provided it’s allowed,” he said.

Wojcik, also a securities lawyer, believes he’s avoiding any Securities and Exchange Commission violations by including boilerplate clauses warning of “risk factors” in his deal, such as that of being prohibited by the government from ever transferring his future checks, or his death.

Ebay took a different view, yanking the auction. This is unfortunate, since it might have yielded some insight into the expected future value of social security benefits. Given that the social security system is expected to be insolvent at reasonable horizons based on current policy settings, one suspects that these benefits would be heavily discounted.

Meanwhile, the NYT discovers that Harvard women produce more valuable eggs than Colombia women:

Q. At Columbia University, there are ads in the student newspaper offering to pay tall blondes with high SAT’s $8,000 to $20,000 for eggs to be used by infertile couples. Is this a good price?

A. Hmm. I think the price for Harvard eggs is higher, around $25,000. There have been ads offering even $50,000 and $100,000 for “exceptional eggs” though no one’s ever come forward to say they’ve gotten that much.

(via MR and Ben Muse respectively)

posted on 25 May 2006 by skirchner in Economics

(0) Comments | Permalink | Main

Who Ya Gonna Call?

David Altig, on why the USD is the currency you run to, not from:

to anyone waiting for the greenback slaughter, I have one question: If, heaven forbid, the global economy goes south, who ya gonna call?

posted on 24 May 2006 by skirchner in Economics

(0) Comments | Permalink | Main

Public versus Private Saving and the Investment Boom

The federal government is running a negative net debt position and budget surpluses of 1% of GDP over the forward estimates. Yet the consensus view among the commentariat seems to be that the Commonwealth should be hoarding even more revenue it doesn’t need. Peter Hartcher argues that given Australia’s current account deficit:

If Peter Costello has the option to allow any unexpected revenues in the coming year to be saved as surplus rather than spent, he should take it.

This argument assumes that there would be no offsetting private sector response to increased public saving, leaving national saving unchanged. The surplus is just a substitution of public for private saving. The domestic saving-investment imbalance that drives the current account is not a function of inadequate private sector saving, but the record investment share of GDP.

To argue for a contractionary fiscal policy to lower the current account deficit is equivalent to arguing that the private sector investment boom in Australia is mistaken and should be curbed. In fact, the investment boom is essential if Australia is to fully capitalise on the opportunities presented by the terms of trade boom.

posted on 19 May 2006 by skirchner in Economics

(0) Comments | Permalink | Main

Bogle Blog

Bogleheads and Vanguard Diehards can now hear their master’s voice at The Bogle Blog.

posted on 18 May 2006 by skirchner in Economics

(0) Comments | Permalink | Main

Fundamentals of Commodity Price Inflation

James Hamilton on commodity price inflation:

One challenge for either the monetary inflation or the speculative bubble view of the commodity price movements is the fact that there is such diversity, with some commodities going up a great deal and others not at all. Indeed, these differences across commodities are actually much bigger in magnitude than the average movements common to them all. Although not entirely discounting the potential role of monetary or speculative factors, I’m therefore inclined to try to interpret much of the relative price movements as resulting from the same factors that have always made commodity prices much more cyclically sensitive than other prices. Specifically, the long lead times in production and short-run demand and supply inelasticity mean the price can be particularly sensitive to demand fluctuations. A broad increase in the level of economic activity can thus lead to a broad increase in the relative price of a particular group, though with huge differences across items reflecting the particular factors of supply and demand in each market.

Supply and demand determining prices? Who would’ve thought?

posted on 17 May 2006 by skirchner in Economics

(2) Comments | Permalink | Main

Tax Cuts Don’t Cause Higher Interest Rates: Part IV

Alan Wood continues the education campaign:

Why this obsession with interest rates? You could be forgiven for thinking the only role for fiscal policy is to hold them down. John Howard and Costello actually do think this, so they can hardly complain if others view their budgets through the same lens.

In fact, not long ago Costello was fending off calls for tax reform by warning it could drive up interest rates. However, if the RBA does raise rates again, as it may, it won’t be because of the budget. Costello will only have himself to thank if he gets the blame.

If he wants to avoid this fate, the Treasurer would be well advised to stop rushing to hold a press conference every time the RBA puts rates up. It associates him with the decision. He should let the RBA get on with its job and shut up.

posted on 17 May 2006 by skirchner in Economics

(1) Comments | Permalink | Main

Discretionary Fiscal Policy: Not Dead Yet

Treasury Secretary Ken Henry addresses some fiscal policy misconceptions in the traditional post-Budget address to ABE:

Clearly fiscal policy is relatively tight – especially by international standards. Should it be tighter? Some think it should, because there is the potential for the terms-of-trade to fall sharply and for income growth to slow. As I have noted, we have already taken out some insurance for this eventuality through our projection assumptions. And while this insurance does not fully unwind the increase in commodity prices, it is substantial, with nominal GDP projected to grow at a rate a full percentage point below its longer term average.

But there are other metrics for ascertaining the suitability or otherwise of the stance of fiscal policy, and these relate to the behaviour of the real economy. Over the recent period, the real economy has been growing at around trend, with output close to full capacity. Furthermore, we have had no significant increase in inflation in this period – no rapid acceleration in prices – with little change in monetary policy settings. It is far from obvious that an alternative fiscal policy approach would have generated superior macroeconomic outcomes.

Some of the criticism of the fiscal strategy appears based on a couple of misconceptions. Let me quickly address those. Having a medium-term fiscal framework does not imply there will only be fiscal surpluses in the future even if the recent increase in commodity prices turns out to be persistent. Importantly, it also doesn’t imply that there can never be deficits. And it does not presage the death of discretionary fiscal policy, as has been suggested by some commentators.

There is an interesting discussion of the long-run implications of recent gains in Australia’s terms of trade.

Liberal MHR Malcolm Turnbull also gives his take on the Budget:

the budget did not target childless, 58-year-old lesbian poets.

posted on 16 May 2006 by skirchner in Economics

(2) Comments | Permalink | Main

The End is Not So Nigh: Roubini Backtracks on Australia and New Zealand (or Does He?)

At the end of March, we criticised Nouriel Roubini’s forecast of a currency and financial crisis in Australia and New Zealand. Proving his value as a contrarian indicator, Roubini’s post on 28 March coincided exactly with the 2006 lows for both AUD-USD an NZD-USD, which then proceeded to rally strongly.

Roubini now argues:

Some critics naively misunde[r]stood my blog as implying that all the countries in my list risked the kind of severe financial crisis that was, at that time, hitting Iceland. Obviously I did not mean that Australia or New Zealand risked a severe financial crisis.

This qualification is far from apparent from his original post. Indeed, it is Roubini who shows signs of naivety in failing to appreciate institutional characteristics of the Australian and NZ economies and financial markets that we have highlighted on this blog on previous occasions, which make a financial crisis due to exchange rate depreciation laughably improbable.

From his latest post, however, it appears that doomsday has merely been postponed:

expect meaningful downward pressures on the Aussie dollar and the New Zealand Kiwi. Such depreciation - given the overall sounder fundamentals - will not lead to the same serious financial distress that emerging market economies with current account deficits (and the even more severe distress that EMs with twin deficits and other financial vulnerabilities) will experience. But it will not be an easy ride for these two currencies and their markets either.

So apparently we are dealing with only a difference of degree rather than kind. Again, this distinction was far from evident in Roubini’s original post. He has also yet to reconcile all this with his bearishness on the USD. As we argued previously, it is a little difficult for both the US and Australia to experience a currency crisis simultaneously, since this implies that the AUD-USD and NZD-USD exchange rates should be relatively stable. Hardly the makings of an Australian or NZ currency crisis.

It is pleasing to see Nouriel at least qualify his previous post. The main flaw in Roubini’s analysis is the way he persists in applying the Asian financial crisis paradigm that made his reputation in the late 1990s as an all-purpose analytical framework, regardless of the institutional realities of the countries in question. It is a framework that doesn’t even fit emerging Asia anymore, much less Australia and the United States. It’s time for Nouriel to get a new shtick.

posted on 16 May 2006 by skirchner in Economics

(0) Comments | Permalink | Main

Tax Cuts Don’t Cause Higher Interest Rates: Part III

Alan Wood still gets it:

A REMARKABLY popular view in markets and elsewhere is that the budget’s tax cuts and spending will drive the Reserve Bank to put up interest rates because of their effect on inflationary pressures in the economy.

Remarkable because it flies in the face of what we have been told by the man who decides monetary policy, Ian Macfarlane. Two years ago, again last year, and again now we have been told by market (and media) analysts the budget tax cuts will drive up interest rates.

Over this period the official cash rate has increased twice - by 25 basis points in March 2005 and another 25 basis points this month. Neither of these rises have had anything to do with tax cuts or fiscal policy more generally.

How do we know? Because the RBA governor explicitly denied any connection with the first rise and has laid out a formula for the relationship between fiscal policy and interest rates that makes it clear he would also deny any connection between the latest rate rise and tax cuts.

And Wowser Ross still doesn’t:

The trouble with it, however, is it ignores the “counterfactual” (what would have happened had you not done what you did) and thus ignores the opportunity cost of Mr Costello’s decision to spend as much this week as he did.

If Mr Costello had spent or given away not one extra cent in the budget, the surplus would have risen from $14.8 billion (or 1.5 per cent) in the old year to $22.4 billion (2.2 per cent) in the new year.

Wowser Ross doesn’t tell us what a government with a negative net debt position is supposed to do with a budget surplus of 2.2% of GDP. Dump it into the Future Fund? Even if we grant Ross his ridiculous counterfactual in which the government hoards even more revenue it doesn’t need, the numbers involved would not yield a significant impact on monetary policy.

Terry McCrann (no link, but see today’s Australian) is appropriately dismissive of the notion that the budget balance has anything to do with the determination of official interest rates. As McCrann notes, fiscal policy is a movable feast and the budget numbers are only as good as the next policy announcement or shift in parameter estimates, rendering Gittins’ counter-factual completely arbitrary.

posted on 13 May 2006 by skirchner in Economics

(0) Comments | Permalink | Main

Tax Cuts Don’t Cause Higher Interest Rates: Part II

Updating the numbers from the previous post, the 1988-89 and 1989-90 underlying cash surpluses are now both put at 1.7% of GDP, compared to an estimated 1.5% of GDP for 2005-06. The high interest rates of the late 1980s were thus associated with the strongest budget surpluses as a share of GDP since 1973-74 and still stronger than any Peter Costello has delivered.

The budget surplus falls to 1.1% of GDP in 2006-07 and is essentially unchanged after that, yielding a fiscal impulse from the budget of 0.4% of GDP.

Alan Wood gets it:

wouldn’t all this tax cutting and spending force the Reserve Bank to put up interest rates again?

The answer is an unequivocal no. Why not? Because what matters to our central bankers, as Governor Ian Macfarlane has explained ad nauseam, is the budget bottom line…

As a per cent of GDP the size of the surplus is forecast to be 1.5 per cent in 2005/06 and 1.1 per cent in 2006/07.

This implies a stimulatory change, using the Macfarlane rule of thumb, of 0.4 per cent of GDP—too small to be even a blip on the RBA’s radar screen.

And, if the experience of Costello budgets is a guide, the forecast surplus of $10.8 billion for 2006-07 will turn out to be a substantial underestimate.

In other words, the actual swing in the surplus is more likely to be mildly contractionary, rather than mildly expansionary.

Ross the Wowser doesn’t:

it’s by spending our tax cuts that we risk adding to inflation pressure and making the Reserve Bank want to raise rates further.

It’s likely that part of the reason for last week’s increase was the Reserve’s knowledge that a tax cut was coming, but I doubt it was expecting anything half as big as what we got. We now have budgetary policy and interest-rate policy pulling in opposite directions - not a recipe calculated to minimise the risk of further rate rises.

Somehow, I don’t think Peter Costello is too worried on that score. And since Ross thinks money makes you unhappy anyway, why would he care?

posted on 10 May 2006 by skirchner in Economics

(8) Comments | Permalink | Main

Page 75 of 97 pages ‹ First < 73 74 75 76 77 > Last ›

|